Pre-approval is one of those things that hit you and make you think, “I’m really doing this thing.” It starts to get serious when you are sending documents to a lender to figure out how much you have and how much you can borrow, and that’s precisely why pre-approval has been very important when searching for homes today. It not only signals to the seller (and agents) that you are serious about your home search, it also gives you a clear picture of how much house you can afford. In this article, we’ll dive into detail why getting a pre-approval is important.

Table of Contents

Why is Pre-Approval Important?

Pre-approval is essentially a green light from a lender that you’re a trustworthy borrower. It not only validates your financial readiness for homeownership but also strengthens your position in the competitive real estate market. Here’s why:

1. Understanding Your Budget: A pre-approval letter gives you a clear understanding of how much a lender is willing to loan you based on your income, debt, credit history, and other financial factors. This can help prevent the heartbreak of falling in love with a house you can’t afford.

2. Strengthens Your Offer: In a seller’s market, having a pre-approval can differentiate your offer from others. Sellers are more likely to accept offers from pre-approved buyers, as it demonstrates you have the financial capability to follow through on your offer.

3. Speeds Up the Home Buying Process: Once you find your dream home and make an offer, having a pre-approval can speed up the loan closing process since the lender has already vetted your financial situation.

Documents You Need for Pre-Approval

Below is a handy cheat sheet of documents you will need to present to your lender for pre-approval:

| Purpose | Documents |

|---|---|

| Proof of Income | • 2 years of W2 statements • Last 2 pay stubs • Most recent 2 years Complete Federal Tax Returns • Additional proof of income (i.e. bonuses or alimony) |

| Proof of Assets | • Most recent 2 months bank statement • Mortgage statements, homeowners’ insurance, HOA statement, rental agreement (if any) |

| Credit Information | • Permission to do a credit check |

| Employment Verification | • Permission to call/email employer • Additional paperwork if self-employed |

| Identification | • Copy of ID/driver’s license |

Choosing the Right Lenders

Once your documents are ready, it’s time to find the right lenders. Considering the significant role a lender plays in the home buying process, selecting a reliable and supportive one can be the difference between a smooth and a tumultuous home buying experience.

1. Online Review Sites: Sites like Yelp provide first-hand reviews about lenders, which can be useful in making a decision.

2. Real Estate Agents: Real estate agents regularly work with a lot of lenders throughout their careers. Do not hesitate to ask your real estate agent if they have any lenders they can recommend.

3. Referrals: Friends and family can often provide valuable insights based on their experiences with lenders.

When considering potential lenders, look for competitive interest rates, responsiveness, and helpfulness. It’s crucial to find a lender who is eager to guide you through the mortgage process and explain any complex terms or procedures.

What To Expect from Pre-Approval?

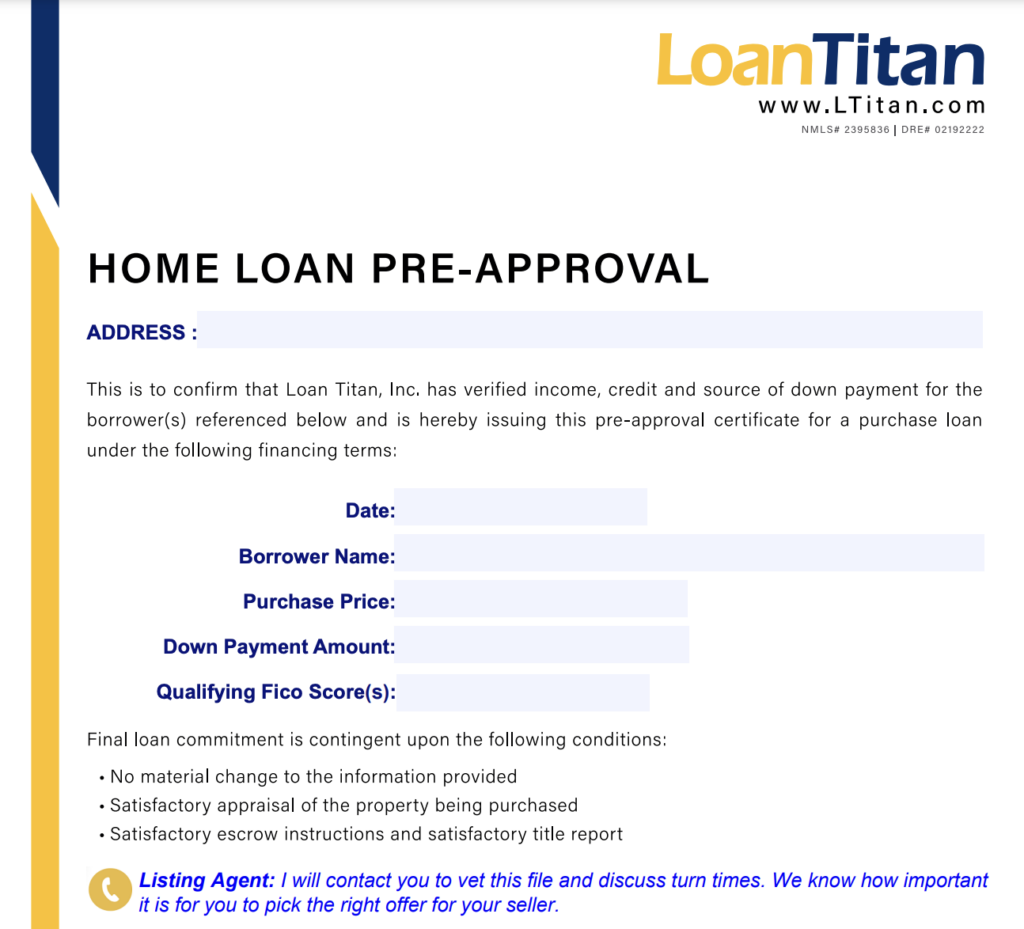

1. Pre-approval letter: This letter, issued by the lender, states your borrowing limit based on your creditworthiness and expected down payment.

2. Home Loan/Interest Rate Quotes: The lender will provide current interest rates, possible points or lender credit, and a summary of estimated additional costs. As pictured below, they can also provide sample mortgage payments, as well as escrow fees.

Important Reminders

1. A pre-approval for a condo and a house may attract different interest rates.

2. A pre-approval is typically good for 60-90 days. If you do not buy a property within that timeframe, you may need to re-apply.

3. Don’t be afraid to shop for lenders. It can help you look for the best interest rates and should not affect your credit score.

4. Interest rates are usually not locked until you have an accepted offer and a scheduled closing date.

5. A pre-qualification is different from a pre-approval. Which one should you get?

In conclusion, mortgage pre-approval is a vital step in your home buying journey. It offers clarity about your budget, gives you an edge in a competitive market, and expedites the buying process. With the right information and understanding of the pre-approval process, you’ll be well on your way to owning your dream home. So, what’s next? Contact a real estate agent to get started on finding your home. If you need an agent or lender recommendations, I’m here to help! Contact me here.

Leave a Reply